Welcome to the Global Business Advisors Forums where business leaders, owners, and advisors can interact, share ideas, celebrate successes, and build a global community of growth oriented entrepreneurs!

To join, you must apply and qualify for membership and agree to abide by our rules. A one time membership fee of $495 USD may apply. Please register and provide your contact information so we may speak to determine if this community is a good fit for you, your business, and our group.

As an SME business leader, owner, or advisor, thank you for driving one half of the gross domestic product in the top 17 countries around the world (according to the World Bank). We need you now more than ever!

I wish you much entrepreneurial success.

Phil Symchych

Founder

Global Business Advisors Forums

To join, you must apply and qualify for membership and agree to abide by our rules. A one time membership fee of $495 USD may apply. Please register and provide your contact information so we may speak to determine if this community is a good fit for you, your business, and our group.

As an SME business leader, owner, or advisor, thank you for driving one half of the gross domestic product in the top 17 countries around the world (according to the World Bank). We need you now more than ever!

I wish you much entrepreneurial success.

Phil Symchych

Founder

Global Business Advisors Forums

Please add your photo to your profile. Click on the far top right image (a circle with two dots), then select to Edit Profile, and Change My Picture.

Please be kind to others. Treat others as you would like to be treated. Be respectful. We are here to learn and share.

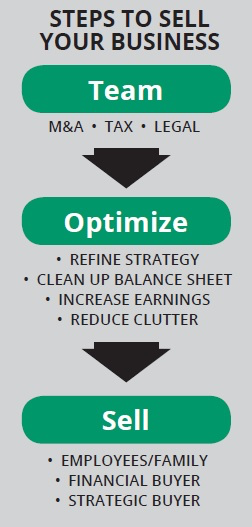

MAKING THE BIG SALE: SELLING YOUR BUSINESS by Phil Symchych

As originally written for Industry West magazine.

Comments

That's a great read, and not very long.

For the purpose of discussion, I'd comment that the flow chart above could show the 4 points in "Optimize" as being top of the list...but only if current management has the capability to do so without the guidance of the "Team."

What I learned too late in my solo practice was that while I didn't approach prospects and clients like they were somehow broken, I did assume that their level of financial acumen was much deeper than it really was, despite what was visually evident in what they had built their enterprise to be. Phil had a great analogy for that!

Kim,

What was my analogy? I don't remember. Is it suitable for family viewing?

You raise a good point that we make many assumptions about our clients and prospects without often validating those assumptions with data. One of the reasons large consulting firms are highly trusted by their large clients is the amount of data the consultants process and analyze.

For everyone, what data do you analyze to validate your prospect's or client's situation prior to advising and implementing solutions?